Salary Sacrifice Leasing Explained

Introduction

If you’re looking to lease a car, you may have heard of salary sacrifice. Salary sacrifice is where an employee agrees to take less money in exchange for company benefits—in this case, putting aside a portion of their pay check towards their car lease. It’s often used by individuals who want to drive the latest models or have more flexible payment options whilst having the advantage of managing their tax burden. But how exactly does it work? What are the advantages and disadvantages? We’ll cover all that and more below!

How Does Salary Sacrifice Work?

Salary sacrifice is a way to help you save money on your car, as well as the tax you pay. It works by reducing your income and therefore reducing the amount of tax that you have to pay.

The basic principle of salary sacrifice is that instead of paying for something out of your own pocket, such as a car, your employer will make payments on behalf of you - in return for which they deduct an agreed sum from your wage each month (as if it were tax). This means that you’re taxable income is lower whilst still getting the benefit of leasing a car.

Why Should I Lease My Car With Salary Sacrifice?

If you’ve ever leased a car, then you know that it’s a great way to get the car of your dreams without paying the full price up front.

But what if you could enjoy an either bigger benefit?

Salary sacrifice leasing is just like regular lease agreements in that it allows you to drive away with a new car every three years or so—but it also allows for some pretty big savings on monthly payments and tax liability. A Lease taken through a Salary Sacrirfice scheme has the added benefit of including all Vehicle Excise Duty (Road Tax), Maintenance, Tyres and Insurance, it truely is a one stop shop for you.

All makes models and powertrains can be leased via a Salary Sacrifice agreement, From Range Rovers and Fiat 500’s, Through to the latest Electric offerings from Tesla and Mercedes-Benz, However as there is a Benefit in kind liability, electric vehicles such as the Mercedes-Benz EQB work best on Salary Sacrifice. Call us now to get a personal illustration of how your dream car would look on a Salary Sacririce Lease with Trio leasing.

Advantages of Salary Sacrifice Leasing

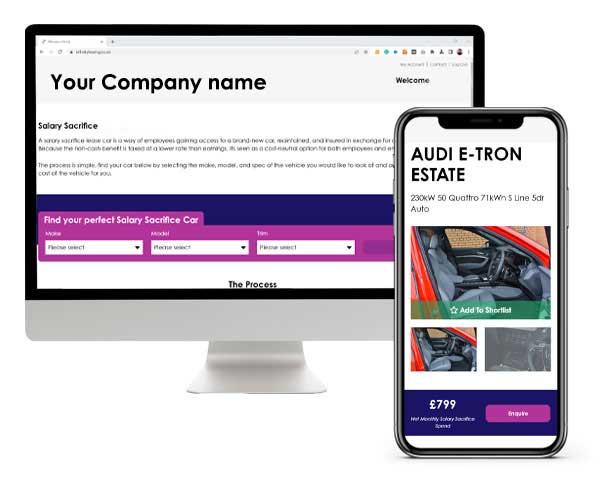

Salary Sacrifice Leasing is a great option for anyone who wants to lease a car, or any business wishing to offer a benefit to their staff without breaking the bank as such schemes can generate savings to both the employee and employer, makiing it a win win all round. Trio Leasing are specialists in this area and undertstand that each Company and its staff are different, we offer a boutique, taylor made solution for you along with a dedicated quating system so you and your colleagues can explore what options work for them at a time that suits their liftestyle. Of Course, our dedicated team are just a call, text or email away should you have any questions

There are many advantages to salary sacrifice, but it is important to understand the disadvantages as well.

The benefits of salary sacrifice leasing

There are many advantages to salary sacrifice, but it is important to understand the disadvantages as well. If you’re looking for a way to save money on your car lease, then this may be the right choice for you. However, there are also some drawbacks that need to be considered before making a decision.

Conclusion

Our team are ready to help now with any questions you have about this amazing product, get in touch today to see if Salary Sacrifice is right for you and your Company